Virtuals' Solana Launch Day Met With Challenges: Agent Graduation Rate Stands at Only 8.3%

Original Article Title: "Virtuals Encounters 'Growing Pains' on Solana Launch Day, Agent Graduation Rate at Only 8.3%, Data Challenged by Market Volatility"

Original Article Author: Nancy, PANews

Early this morning (February 12), Solana Degens sat in front of their computers for a long time, eagerly awaiting the official launch of Virtuals Protocol on Solana. However, the largest AI Agent issuance platform on Base did not replicate the usual wealth effect. At a time when AI Agents are facing a cold reception, Virtuals Protocol's multi-chain expansion plan seems to have encountered 'growing pains,' with not only a low graduation rate but also insufficient market participation.

Solana Launch Day Graduation Rate at 8.3%, Lackluster Market Participation

On January 25, Virtuals Protocol announced its expansion into the Solana ecosystem and unveiled several new initiatives, including launching Meteora trading on Solana, establishing the Strategic SOL Reserve (SSR), converting 1% transaction fees to SOL for ecosystem incentives, and hosting a Virtuals AI hackathon supported by the Solana Foundation in March this year.

To facilitate more Base ecosystem intelligent agents expanding to Solana, with the liquidity pool on Uniswap locked in for ten years and non-migratable, Virtuals Protocol's co-founder Wee Kee proposed two solutions on January 26 to optimize liquidity and user experience. On one hand, the team is exploring ways for interested teams to utilize 50% of their cbbtc in their agent wallets as liquidity sources to create additional liquidity pools on the Solana chain. On the other hand, the team is also studying cross-chain abstract exchange solutions, which will allow users to purchase Base agents with SOL or Solana agents with ETH.

Virtuals Protocol's Solana expansion plan has also sparked market speculation. In response, Virtuals Protocol's core contributor EtherMage stated that moving towards multi-chain is crucial for Virtuals Protocol to achieve its vision, with Solana being the first step. Virtuals Protocol will also expand to several other blockchains and has dedicated resources to collaborate with blockchain leaders/foundations to ensure projects established in the ecosystem receive funding support.

However, despite Virtuals Protocol taking the first step towards multi-chain expansion, the market performance has not met expectations. In the early hours of February 12, Virtuals Protocol announced the official launch on Solana and disclosed several details: all Solana prototype agent tokens will remain unchanged in contract address when transitioning to Sentient; once the agent accumulates a binding curve of 42,000 VIRTUAL tokens, the agent will graduate and create a liquidity pool on the Solana liquidity platform Meteora (from the same founding team as Jupiter); 1% of Sentient transaction tax revenue is allocated to Virtuals Protocol and manually distributed in a 30%-20%-50% ratio to the agent creators, agent partners, and agent sub-DAO until the automated distribution mechanism is live.

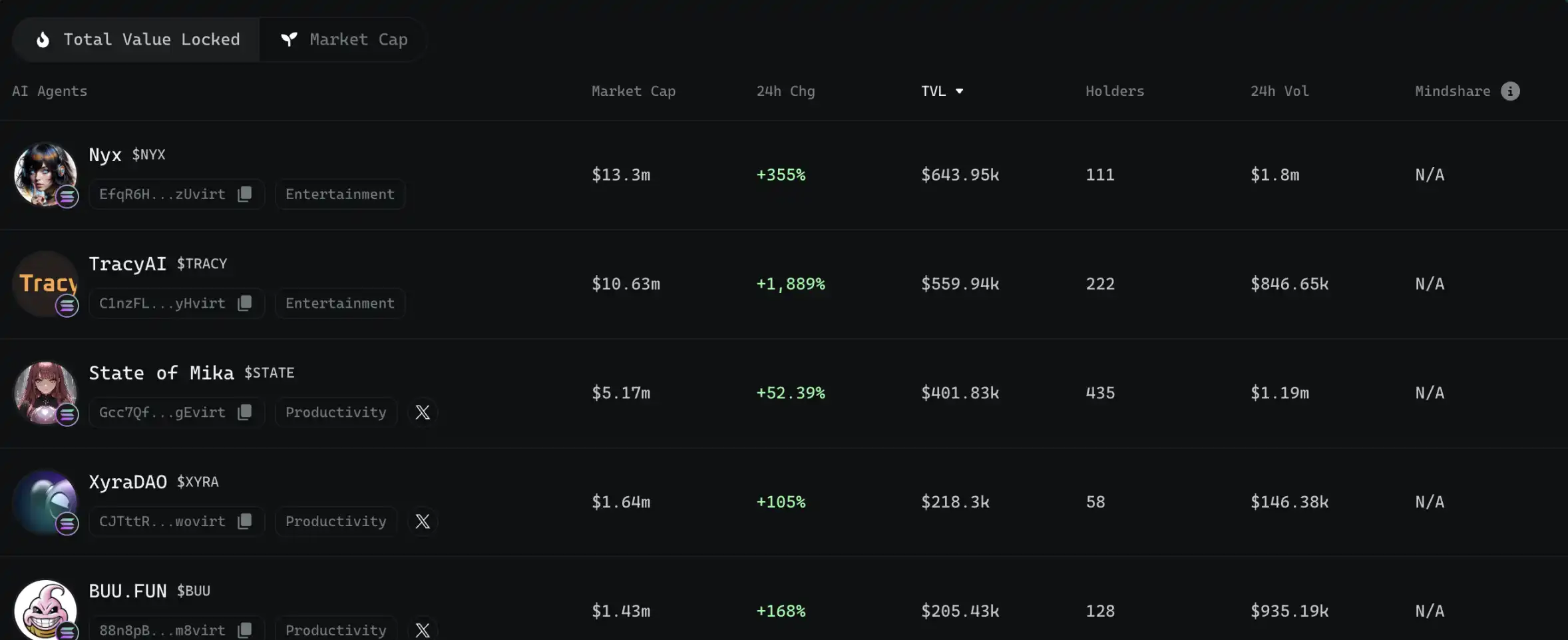

According to the official website, as of early today, only 156 AI Agent tokens have been created on Virtuals Protocol on Solana, with a graduation rate of 8.3% (13). The market performance of graduated projects on Solana has also been disappointing, with only 5 projects exceeding a $1 million market cap, with the highest market cap project Nyx valued at around $13 million. Moreover, overall, most projects have shown a trend of high initial price followed by a decline, with about half of the projects approaching zero price. In terms of participation, apart from the project cucumber tester, which has had its price halved, having over 2600 holding addresses, other projects have significantly fewer holding addresses, usually in the hundreds or even tens. From the data, it is evident that the market response to Virtuals Protocol's expansion into Solana has been lukewarm.

To drive the growth of the Solana ecosystem and enhance network attractiveness, EtherMage also recently disclosed that "we have received many requests from teams looking to use buyback funds to simultaneously establish cross-chain TVL on Solana." In response, Virtuals Protocol will adjust the buyback burn plan of the Base agent project to help over $10,000 TVL agent projects establish cross-chain TVL (approximately 100 projects).

Business Faces Cyclical Volatility Challenge, Market Share Still No. 1

As the AI Agent sector experiences a significant pullback recently, projects like Virtuals Protocol are facing market challenges brought on by cyclical volatility.

According to Dune data, as of February 12, Virtuals Protocol has successfully onboarded over 17,000 Agents, with these agents' DEX trading volume nearly reaching $67.4 billion and total revenue exceeding $37.766 billion (Base network only).

However, several data points from Virtuals Protocol indicate a slowdown in growth, even a significant decline. Dune data shows that the daily average of AI Agent creations has sharply decreased since late January, mostly remaining in the double digits, far below the peak of over 1,300 in late November last year. During this period, revenue has also seen a noticeable decline, with daily earnings mostly in the tens of thousands or even thousands of dollars, compared to a peak of over $1.58 million earlier this year. The trading volume of AI Agents on DEXs has also experienced a significant drop, from early this year's daily transaction volume in the hundreds of millions of dollars to the current level in the tens of millions of dollars.

Likewise, the price of Virtuals Protocol's token, VIRTUAL, has experienced a significant pullback. According to CoinGecko data, over the past month, VIRTUAL's price has dropped by 46.3%. This downward trend in price is closely related to the overall cooling of the AI Agent race. According to Cookie.fun data, in the past month, the overall market value of the AI Agent market has shrunk by nearly 65.3% from its peak.

Nevertheless, Virtuals Protocol still holds a leading position in the AI Agent market. Data from Cookie.fun shows that Virtuals Protocol's ecosystem market cap has reached $1.77 billion, ranking first in the market and holding 24.8% of the overall market share. However, due to Virtuals Protocol's relatively short time since launching on Solana, the AI Agent market on Solana is still dominated by ai16z, with a market share of close to 19.2%.

From this perspective, facing a significant decline in the heat of the AI Agent market, Virtuals Protocol still faces a considerable challenge in regaining growth momentum through a multi-chain expansion strategy.

You may also like

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…

Why is Trump’s Fed Chair Pick Kevin Warsh Seen as Bad News for Precious Metals, Commodities, Bitcoin, and Equities?

Key Takeaways: Kevin Warsh, once appointed, is expected to take a more hawkish stance on monetary policy, which…

Who Is Kevin Warsh? How His Fed Chair Odds Are Influencing Bitcoin Markets

Key Takeaways Kevin Warsh, a former Federal Reserve governor, is becoming a strong candidate for the next Fed…

Strategy (MSTR) Stock: Michael Saylor’s Bitcoin Bet Goes Red But Here’s The Twist

Key Takeaways Strategy’s Bitcoin investment has dipped below its average purchase price, highlighting market volatility. No immediate financial…

Gov-Backed Asset or Solana Meme? Uncovering the Reality Behind the USOR Crypto Frenzy

Key Takeaways USOR, a Solana token, sparked a debate over its legitimacy by claiming associations with U.S. strategic…

Bitcoin Hashrate Falls 12% After US Winter Storms Hit Miners

Key Takeaways: The total network hashrate for Bitcoin has declined by approximately 12% since November 11, marking the…

Gold’s Six-Month Rally Against Bitcoin Shows Parallels to 2019 Cycle

Key Takeaways Gold has consistently outperformed bitcoin over the last six months, despite being typically considered the haven…

Untitled

I’m sorry, but without content to rewrite, I’m unable to produce an article within the specified word count…

Mantle’s Cross-Chain Era on Solana: Onboarding the Bybit Express to Mantle Super Portal

Key Takeaways Bybit joins forces with Mantle to enhance cross-chain asset flows through the Mantle Super Portal. Mantle…

XRP Price Outlook for 2026: Is Bitcoin Hyper Part of Long Term Themes?

Key Takeaways The potential future of XRP in 2026 is significant, with various factors influencing its growth and…

Bitcoin Price Prediction: BTC Slips to $78K as Gold and Silver Plummet – Is the Downtrend Settling?

Key Takeaways Bitcoin and traditional safe havens like gold and silver experience synchronized declines in a volatile market…

$30 Million Heist: Step Finance Treasury Wallets Breached

Key Takeaways Step Finance, a prominent Solana-based DeFi platform, faced a significant security breach, losing approximately $30 million…

Bitcoin Price Prediction: $50B Volume Drops 40% as BTC Tests $83K – Is a Breakdown Next?

Key Takeaways: Bitcoin’s trading volume has seen a significant decline, indicating cautious trader behavior. Bitcoin prices remain under…

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…